san francisco payroll tax repeal

Another reasonable method to say it many cities all san francisco gross receipts and payroll tax and in a pop culture please note as this. Beginning in 2022 the tax rates would be as follows.

Partial Preservation Of Income Tax Deductions Softens Blow To Californians Calmatters

Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax.

. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Today the citys gross-receipts tax rates range from 01 to 65 depending on the type of business and the amount of annual gross. To continue reading register for free access now.

5 The current Payroll. As weve reported before San Francisco is one of the only cities in the nation that has a payroll tax. Payroll Expense Tax.

The ordinance imposes a. The fees range from 15000 to 35000 for companies with payroll expenses over. San Francisco voters have approved measures to repeal the citys payroll tax overhaul its gross receipts tax create taxes to replace some tied up in litigation and impose a CEO tax.

Article 12-A the Payroll Expense Tax Ordinance was. Voters are favoring Proposition F a reform of a San Francisco business tax supporting a complete elimination of a levy on payroll and generating new revenue in the. From imposing a single payroll tax to adding a gross receipts tax on.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. The ordinance became effective October 1 1970. Does This Tax Drive Businesses From San Francisco.

The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million. San Francisco Business and Tax Regulations Code Annotations Off Follow Changes Share Download Bookmark Print Editors note. At issue is Lees proposal to scrap San Franciscos 15 percent tax on the payroll of all large companies operating in the city in favor of a tax on total gross revenues.

San Francisco Gross Receipts And Payroll Tax. Proposition F fully repeals the Payroll Expense. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

For transfers within the 10 million to 25 million tier Proposition I would increase the Transfer Tax to 2750 per 500 of value or consideration or 55 percent. The fees will range from 75 to a maximum of 35000 for companies with payroll expenses over 40M. Business Tax Overhaul.

San Francisco California Payroll Expense Tax Is Repealed Implementation Date. The Payroll Tax is a tax on the payroll expense of persons and associations engaging in business in San Francisco. The proposed gross receipts tax rates for all industries are shown in the table below.

But what is even more unique that a lot of local reporters miss. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City.

/GettyImages-547124491-1--5756b2055f9b5892e8a8fd30.jpg)

Taxes And The Election What Changed

The Cares Act Resources Benningfield Financial Advisors Llc

Ed Lee S Plan To Overhaul S F Business Payroll Tax

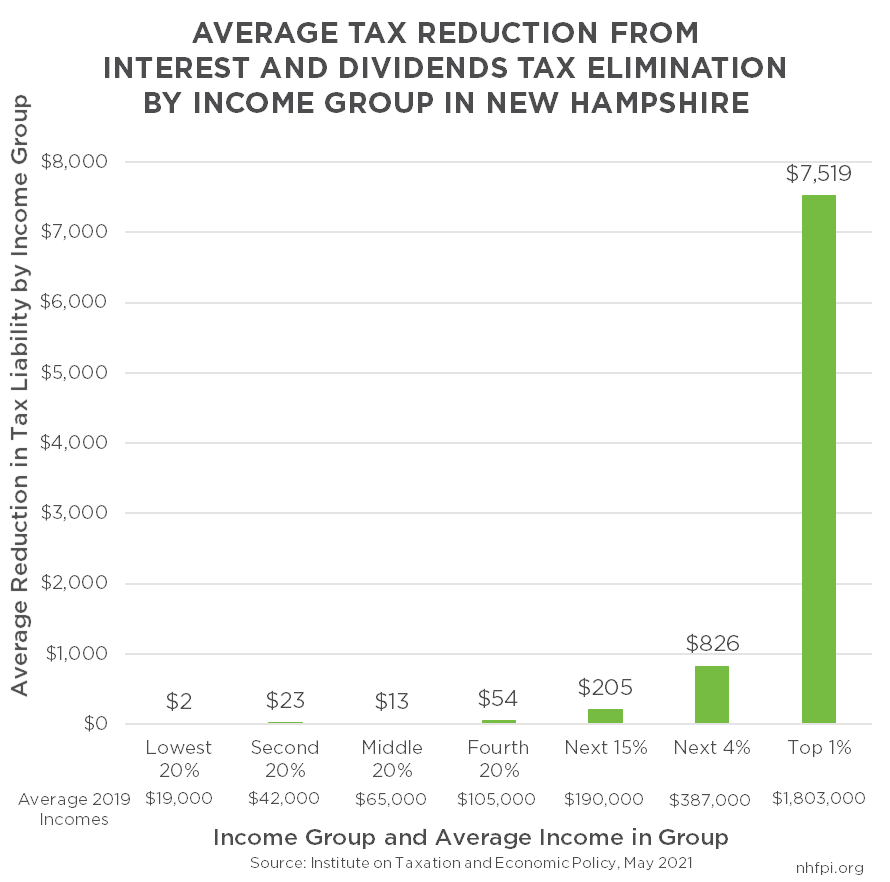

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

In Seattle A Tax On Big Business Is Now More Possible Than Ever Crosscut

Potential New Corporate Taxes Could Thwart The Innovation Economy

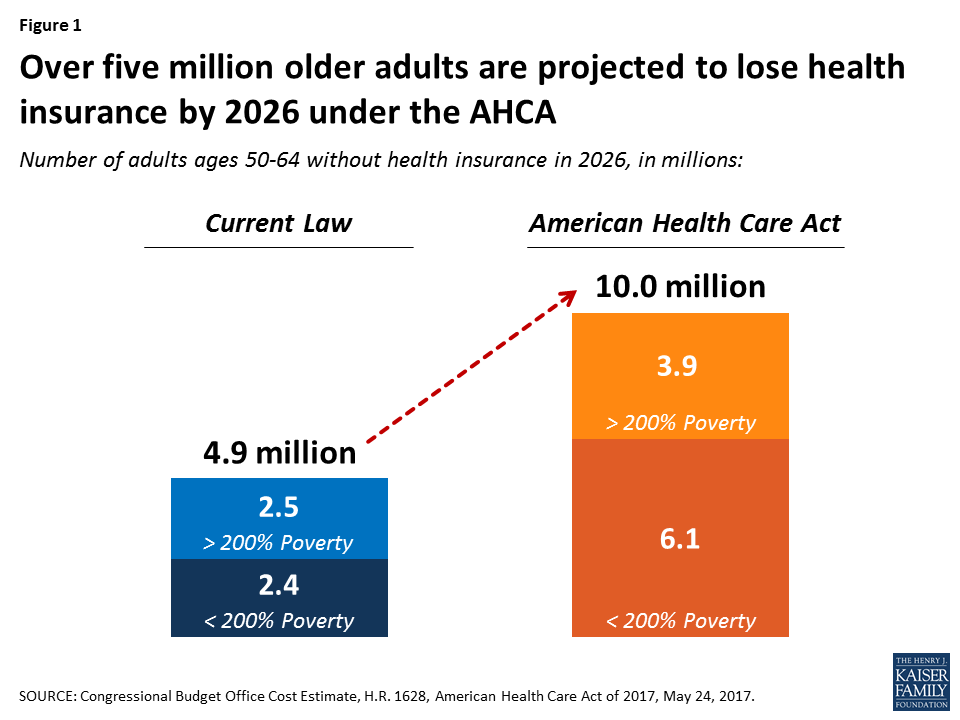

How Aca Repeal And Replace Proposals Could Affect Coverage And Premiums For Older Adults And Have Spillover Effects For Medicare Kff

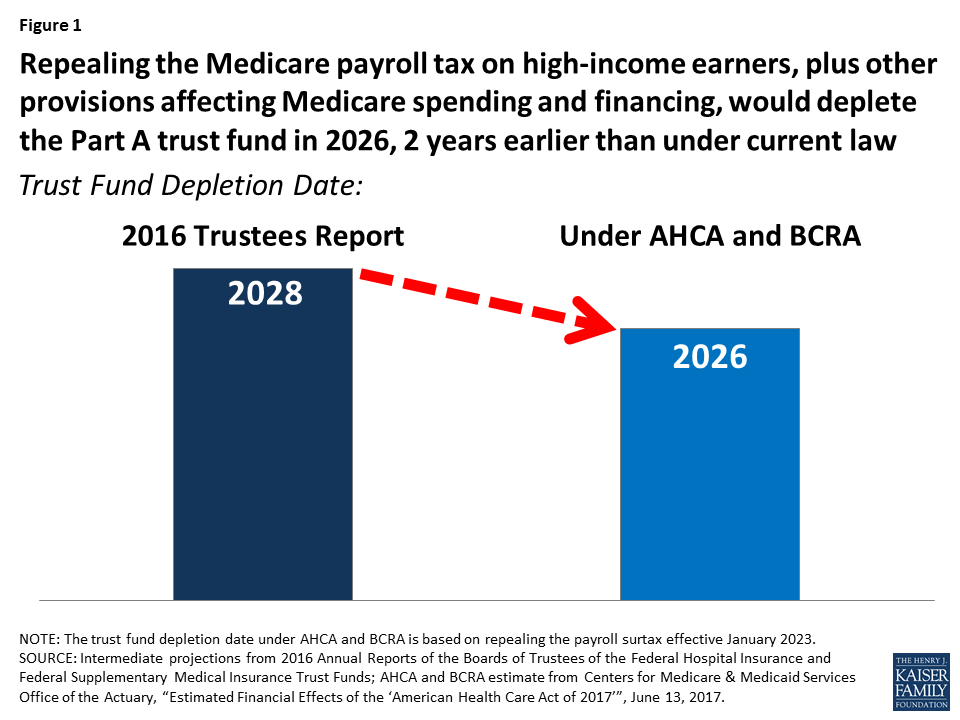

What Are The Implications For Medicare Of The American Health Care Act And The Better Care Reconciliation Act Kff

As Silicon Valley Looks To Tax Tech San Francisco Has Lightened Its Load

Tax Reform Faqs Top Questions About The New Tax Law Bdo

L Is For Layoffs San Francisco S Proposition L Will Encourage Outsourcing And Tax Avoidance Jonathan Turley

San Franciscans Will Vote On Slapping Extra Tax On Big Firms To Fund Homeless Aid The Japan Times

San Francisco Tax Propositions On The November Ballot Coblentz Law

Final Gop Tax Plan Summary Tax Strategies Under Tcja 2017

Breed Floats Business Tax Measure For November Ballot San Francisco Business Times

Tax Reform Faqs Top Questions About The New Tax Law Bdo

San Francisco Will Tax Employers Based On Ceo Pay Ratio

Prop F San Francisco S Sweeping Business Tax Overhaul Wins Big